- Capabilities

- Industries

- Businesses

-

- Insights

-

- About Us

-

-

NYSE: NNI

- Loading...

Pricing delayed 20 minutes

-

-

-

- Careers

-

-

Our customers are our clients, leaders, team members, and peers. I love the fact that every day the people I work with are completely different.

Stacy

Nelnet manager

-

-

-

For companies that incorporate environmental, social, and governance (ESG) factors into the underwriting process for their solar tax equity investments, there are numerous positive outcomes for the companies themselves, the public, and the environment. Learn how you can boost risk-adjusted returns and lower federal tax liability while generating environmental, social, and other public benefits in our complete white paper – or read on for a preview.

What are Green Impact Investments?

Strategic, forward-looking companies can proactively address climate-related risks and the transition to a net-zero economy by investing in solar energy projects that generate federal solar investment tax credits (ITCs). Often termed green impact investments, these investments can help bolster your company’s commitment to a sustainable, clean energy future by qualifying as a climate-smart ESG investment, while boosting your company’s bottom line.

These investments typically offer a quick return of capital into a relatively lower-risk infrastructure asset with the majority of the return coming from the ITC, which is recognized immediately when a solar project is placed in service and becomes operational. By incorporating ESG factors into the investment process, your company can better insulate your investment from material internal and external risks – maximizing environmental, social, and other benefits.

Why Solar Tax Equity Investments are Good Investments

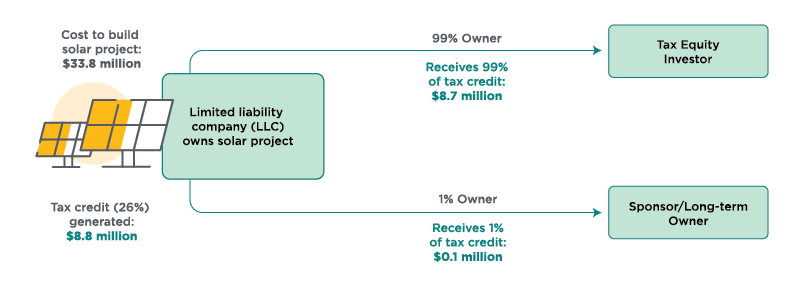

The ITC is a one-year federal tax credit that is awarded to the owner(s) of a solar project at the time the project is turned on and placed into operation. As the owner, you can use this tax credit immediately to offset taxable income generated from other business operations in the current tax year. In a typical solar tax equity structure, the solar tax equity investor is a 99% owner and therefore receives 99% of the ITCs.

To minimize the risk of IRS recapture of the tax credit, the ownership and use of the solar project are typically structured to avoid changes in ownership or use of the project during the first five years following the project’s placement into operation – a period of time the IRS has designated as the “ITC recapture period.”1