For companies that incorporate environmental, social, and governance (ESG) factors into the underwriting process for their solar tax equity investments, there are numerous positive outcomes for the companies themselves, the public, and the environment.

If you want to take a deeper dive into this topic, download our free white paper. Or, read on for a preview of how you can boost risk-adjusted returns and lower federal tax liability while generating environmental, social, and other public benefits.

What are Green Impact Investments?

Strategic, forward-looking companies can proactively address climate-related risks and the transition to a net-zero economy by investing in solar energy projects that generate federal solar investment tax credits (ITCs). These “green impact investments,” as they’re often called, can help bolster your company’s commitment to a sustainable, clean energy future by qualifying as climate-smart ESG investments, while boosting your company’s bottom line.

These investments typically offer a quick return of capital into a relatively lower-risk infrastructure asset with the majority of the return coming from the ITC, which is recognized immediately when a solar project is placed in service and becomes operational. By incorporating ESG factors into the investment process, your company can better insulate your investment from material internal and external risks—maximizing environmental, social, and other benefits.

Why Solar Tax Equity Investments are Good Investments

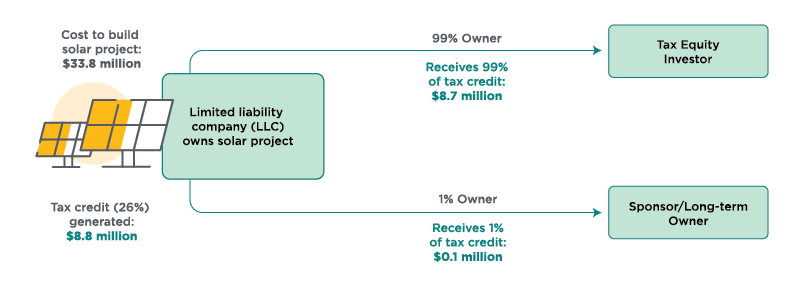

The ITC is a one-year federal tax credit that is awarded to the owner(s) of a solar project at the time the project is turned on and “placed in service.” As the owner, you can use this tax credit immediately to offset taxable income generated from other business operations in the current tax year. In a typical solar tax equity structure, the solar tax equity investor is a 99% owner and therefore receives 99% of the ITCs.

To minimize the risk of IRS recapture of the tax credit, the ownership and use of the solar project are typically structured to avoid changes in ownership or use of the project during the first five years following the project’s placement into service—a period of time the IRS has designated as the “ITC recapture period.”1

The solar investment tax credit is one of the most important federal policy mechanisms to support the growth of solar energy in the United States. Since the tax credit was enacted in 2006, the U.S. solar industry has grown by more than 10,000%—creating hundreds of thousands of jobs and investing billions of dollars in the U.S. economy in the process.2

Let’s take a look at the typical ownership structure for a solar project:

Solar Project: Typical Ownership Structure

As a solar tax equity investor, it’s not uncommon for you to:

- Break even on invested capital within eight to 18 months of investment.

- Depending on project size, have a projected after-tax return on investment (ROI) and internal rate of return (IRR) in the double digits.

The various components of your ROI can include:

- ITCs (amounting to a dollar-for-dollar reduction in federal tax liability).

- Cash distributions from the sale of renewable energy.

- Other tax benefits (e.g., accelerated depreciation).

- Anticipated proceeds upon the investor’s exit from the partnership.

Additionally, you typically do not invest a material amount of capital until the solar project is “mechanically complete.” This tends to insulate you as an investor from a large portion of the development and construction risk associated with the project, making your investment attractive from a risk-adjusted return perspective.

How “Impact Investments” Can Help Your Organization

Solar tax equity investments are also attractive from an impact and organizational perspective. These investments qualify as “impact investments” because the return can be measured not only financially but also in terms of avoided greenhouse gas emissions, renewable energy generated by the investment, and homes, businesses, and communities powered by renewable energy generation.

Impact investments—and solar tax equity investments specifically—are also recognized as advancing U.N. Sustainable Development Goals such as promoting affordable and clean energy; decent work and economic growth; innovation and infrastructure; sustainable cities and communities; and climate action.3 Finally, if your organization has a conscientious, purpose-driven investment strategy that includes impact investments, you’ll draw in more employees, attract more customers and investors, and be better prepared for the transition to a net-zero economy.

How Integrating ESG Factors Can Boost Returns and Impact

Solar tax equity investments inherently address climate change head on, but these investments are not without their complexities. By integrating ESG factors in the investment underwriting and management process, you can enhance returns – financial and otherwise – and better manage risk. Examples of such integration include:

- Seeking out solar projects in areas of high carbon intensity to maximize potential carbon offset.

- Inquiring of the solar developer’s human capital policies, procurement policies, use of local and diverse vendors, and community engagement strategy.

- Ensuring you have customary representations and warranties in the investment documents, along with customary conditions precedent to funding and investor consent rights.

These are just a few of the numerous ESG considerations that should be factored into your solar tax equity investment underwriting process to maximize your impact and minimize your risk. Read our full paper for a more extensive list of practical ways to integrate environmental, social, and governance factors into the investment process.

Nelnet and Our Integration of ESG Factors

Between our own capital and capital from our co-investment platform, our tax equity team has committed over $620 million since 2018 in solar tax equity investments, supporting the construction and operation of solar projects. While tax equity investment is what got us started, our impact expanded exponentially when we created our Nelnet Renewable Energy brand and launched our co-investment platform, solar installation, and renewable energy innovation and partnership solutions.

Tell the Story of Your ESG Efforts

Find key data points that illustrate the financial and ESG impacts of your investments. We note that, while environmental benefits of investments can be substantial, environment impacts are challenging to accurately determine. The U.S. Environmental Protection Agency offers several environmental impact calculators that can be useful in estimating impact to help tell your story.

The following statistics help tell the story of Nelnet’s role in helping to facilitate impact investing. Solar projects constructed and operated using $620 million of Nelnet’s own and our co-investors’ capital, collectively, produced these results:

Of energy generated

Homes powered

Overall fair market value for projects placed into service to-date

Weighted average ROI

Partnerships with different solar developers

Maximizing Our Investment Impact

To enhance our underwriting process and help uncover hidden value in our investments, we’ve taken steps at Nelnet Renewable Energy to integrate ESG factors into our investment underwriting process and ongoing engagement and stewardship activities. We were named the 2021 Green Business of the Year by the Lincoln (Neb.) Chamber of Commerce for our efforts.4 Additionally, we had the first-ever solar tax equity investment rated by S&P Global for its ESG performance, which received the highest score possible (an E1 rating).5

Download Your White Paper Now

"*" indicates required fields