Where Real Life Meets the Classroom

The room buzzes with nervous energy as middle school students begin to budget for rent, taxes, insurance, transportation, and other needs and wants. At the center of the commotion stand Nelnet volunteers including Natalie Artibee, a Nelnet Diversified Services Managing Director and longtime Junior Achievement (JA) Rocky Mountain volunteer—gently guiding students through their first lesson in financial independence.

“You can’t stream Netflix if you can’t afford groceries,” she says with a smile, as a group of students groan at the realization that their favorite luxuries might not fit into their carefully constructed budgets.

For many, this is the first time the abstract world of adulthood—paychecks, bills, insurance, and hard choices—feels real. “It’s pretty eye-opening for students,” Artibee observes. “You get high school seniors and juniors—a lot of them already have a job. They already know what it means to pay taxes. But your eighth and ninth graders see a $500 to $1,000 reduction in their paycheck for taxes and it’s like, ‘But I made this much money.’ ‘Well, you only get to take home this much.’”

The simulation at JA Finance Park is more than just a field trip. It’s a curated, hands-on experience that challenges students to make tough decisions—sometimes for the very first time.

“Everybody wants a car that’s probably more than what most people can afford for a first car,” Artibee laughs. “The cost of housing’s pretty surprising and alarming… And then when students see what’s left over and they have to buy clothes or school supplies or groceries, they have to adjust their choices. ‘I’m just going to buy the generic of everything’ or ‘I don’t need to go out to eat.’ And that’s when you have conversations: ‘Is that really how you want to live?’”

For Artibee, these moments—when students connect the dots between their choices and their futures—are what make volunteering with JA Rocky Mountain so rewarding. She explains, “You can budget anything, and then when you actually have to pay for it, you have to stay within your take-home pay. Watching students gain that understanding is pretty fun.”

The Volunteer’s Journey

For Natalie Artibee, volunteering with JA Rocky Mountain wasn’t just a chance encounter—it was a calling shaped by her own family’s journey and a desire to fill a gap she saw in public education.

Years ago, she got involved with JA through Nelnet colleagues who were already volunteering. “We had people involved in classrooms, at Finance Park, and [Nelnet Executive Director and Legal Counsel] Bill Munn served on the JA Rocky Mountain Board,” she recalls.

Eventually, when Munn decided to step down after a decade of service, he invited Artibee to take his place. She interviewed with JA and they voted to accept her on the board, where she’s served since 2020.

Artibee’s commitment to financial literacy was reinforced by a personal experience that occurred before she began volunteering with JA. When her daughter was transitioning from high school to college, they had candid conversations about what college would mean—financially and otherwise. “I made her build a spreadsheet and evaluate the cost of education, the expenses while she’s at school, depending on where she wanted to go, how she wanted to live, and what her expectations were—just to help her understand the decision-making process,” Artibee explains.

That experience underscored for her the importance of teaching financial skills early, inspiring her to volunteer and advocate for financial literacy in schools.

I think financial literacy is really important. And… it’s a giant gap in public education right now. More schools should have financial literacy requirements to graduate

For Artibee, every hour spent volunteering is a chance to help students gain the skills she wishes every young person had before stepping into adulthood. “It’s a really rewarding experience and a great way to share knowledge helping every student understand how making choices impacts each one of them,” she emphasizes.

The real magic happens for Artibee when she steps into the classroom—and especially, into the immersive world of JA Finance Park.

Inside JA Finance Park: The Student Experience

One of JA Rocky Mountain’s signature programs is JA Finance Park, a capstone experience for middle and high school students. The program begins with a series of classroom lessons led by educators and volunteers, covering topics such as budgeting, saving, investing, taxes, and career exploration. The curriculum is designed to help students build a foundation for making smart financial decisions that last a lifetime.

The highlight of JA Finance Park is a hands-on budgeting simulation, supported by volunteers with real-world experiences to share. Students are assigned hypothetical life scenarios—stepping into a world where every decision counts. They’re armed with a new identity, complete with a job, a salary, a family, and a stack of bills.

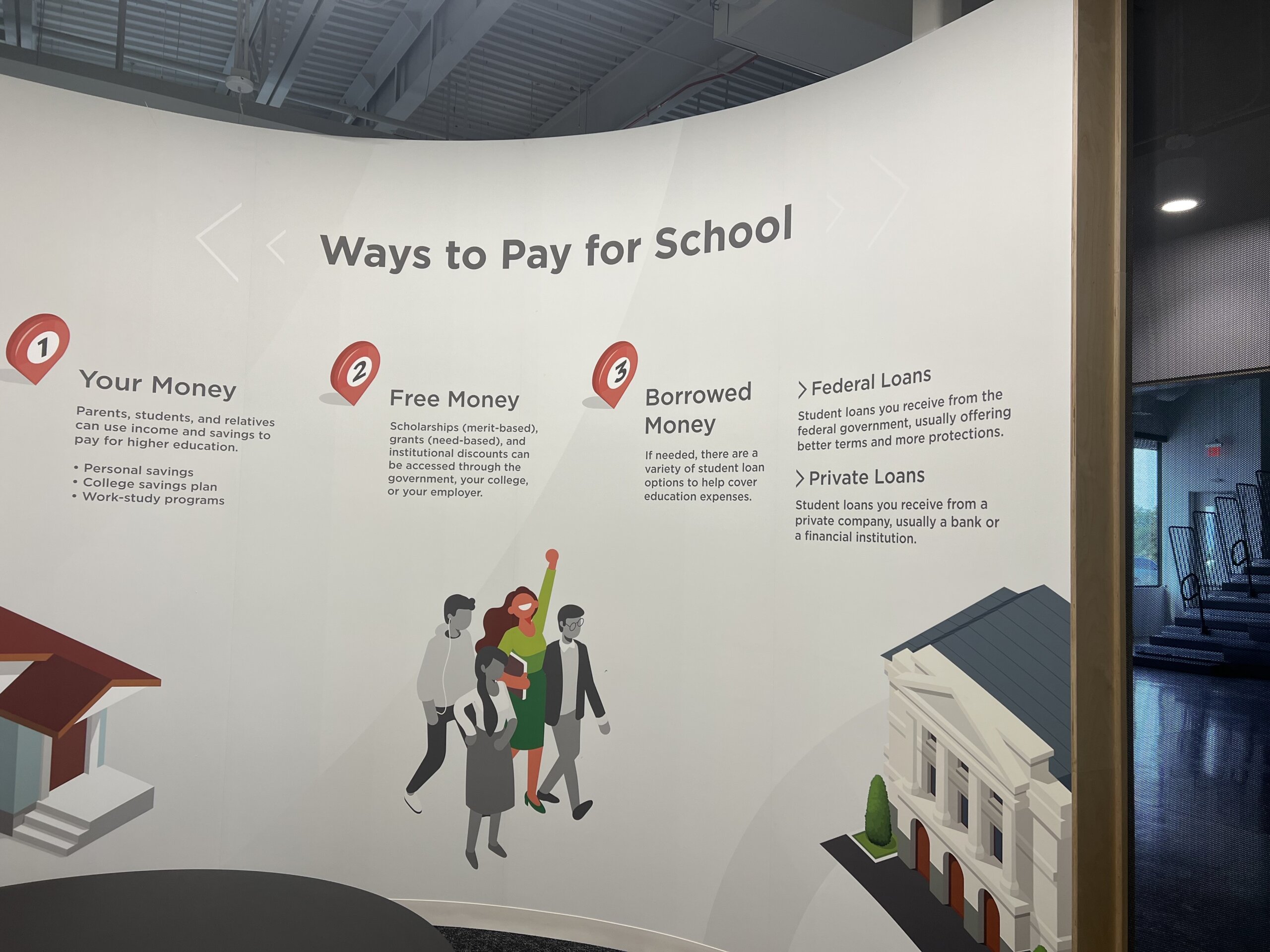

The simulation is designed to be as real as possible, with business “pods” representing everything from banks and car dealerships to insurance agencies and, of course, the Nelnet pod. Volunteers like Natalie Artibee guide students through the process, helping them understand the difference between needs and wants, and the real-world impact of financial choices.

“In Finance Park, they have different business hubs—U.S. Bank, Toyota, Nelnet, American Furniture Warehouse—where the students go to purchase a car, pay their student loan debt, buy furniture, and so on,” explains Artibee. “And in the process, the volunteer explains what that means to them. So when you’re going to buy a car, you might choose to buy a family car, or you might choose to buy a Maserati. You might choose to finance a car. And while they’re in that pod, we explain to them what all those things mean.”

At the Nelnet pod, volunteers like Artibee help students understand the realities of investing in continuing education and the impact on career choices. She explains, “When I go and I represent the Nelnet group, it’s really important to talk about ways that you don’t have to take out student loans to go to school. You can work on your academics now and get some grants or scholarships… I provide some examples of how corporations will provide scholarships with submissions of essays, or tuition reimbursement.”

The simulation is tailored for different age groups, from eighth graders to young adults.

Throughout the day, the room is alive with discovery, frustration, and laughter. Students debate whether to splurge on streaming services or settle for generic groceries, and volunteers gently nudge them toward smarter choices.

By the end of the simulation, students have a new appreciation for the adults in their lives—and for the power of their own choices. The experience is designed to be eye-opening, practical, and, above all, empowering.

While every simulation is unique, some lessons have more lasting power.

Stories That Stick: Student Transformations

Some lessons from JA Finance Park linger long after the field trip ends. For Natalie Artibee, it’s the students’ “aha” moments—their surprise, their pride, and sometimes their vulnerability—that make the experience unforgettable.

She recalls a recent session where a student, after learning about the true cost of health care, made a surprising decision on the spot: “We were talking about how you can get medical insurance through an employer, or you can buy it on the open market. And he said, ‘I’m picking my college because I can have insurance through the school.’ Wow. There’s just those basic things kids don’t even acknowledge. They know the material stuff—a cell phone, clothes, food—but the things like health care is quite surprising.”

We had one kid last week and it was medical insurance we were talking about and he said, ‘I’m picking my college because the college offers free medical insurance to students.

Other stories are more personal. Artibee recalls, “I had one student whose second language was English. His parents had to start working before they left elementary school on a farm in another country… He got a pretty decent paying job in the simulation, something that paid around $70,000. He couldn’t believe how far his money went. He’d like to get into medicine, but he didn’t think that he could afford medical school, so he thought maybe he’d do something else. We talked about what trade schools were. He was unfamiliar with the term. We explored the idea of being an electrician and that the cost of education would be less than med school.”

Sometimes, the impact is as simple as a new appreciation for family, and the responsibilities they shoulder.

I think the biggest aha that I really enjoy is when kids say, ‘I can’t believe my parents have to pay that much. It’s kind of surprising. Or, ‘My parents are paying for school.

For students from schools where most qualify for free or reduced lunch, the lessons can be even more profound.

As Artibee explains, “The school I volunteered with in February was 92% free or reduced lunch. Those kids’ expectations were very different than the kids we did last week that were closer to 55% reduced lunch. Students’ aspirations are very different. Often, first-generation American students simply desire to graduate and just hope to attend school. Expanding their vision is an incredible experience. They understand that money only goes so far and you have to actually invest in yourself, whether that’s savings or education or planning for retirement.”

What sticks with Artibee most is the sense that, for some students, this is the first time anyone has shown them what’s possible. “You don’t know what was meaningful conversation to them—or how their conversation with Mom or Dad or Grandma and Grandpa went when they got home.”

While these stories remain vivid in Artibee’s memory, tens of thousands of young people are impacted each year by JA Rocky Mountain’s programs.

JA Rocky Mountain’s Legacy

Natalie’s story is just one vibrant thread in the rich tapestry of JA Rocky Mountain’s 75-year history.

Over its impressive 75-year history, JA Rocky Mountain has been dedicated to preparing young people for success in work and life. Serving Colorado and Wyoming, the organization delivers hands-on programs in financial literacy, entrepreneurship, and career readiness—reaching tens of thousands of students each year at no cost to schools or families.

Since its early days of bringing volunteers into classrooms to inspire young learners, through the creation of real-world simulations that help students understand how educational and career choices interact with budgeting decisions, JA Rocky Mountain continues to help students with career readiness and life success.

You just never know where you’re going to have an impact in a kid’s life. You don’t know what they walked away with… but if you can touch a kid’s life, that’s really rewarding.

Today, JA Rocky Mountain serves nearly 100,000 students annually, at no cost to schools or students, thanks to the dedication of volunteers and the support of partners like Nelnet. That support includes a multi-year grant from the Nelnet Foundation, helping JA Finance Park deliver immersive financial literacy experiences to thousands of students each year.

2024/25 School Year Impact

Students Reached

Schools Served

Districts Impacted

JA’s mission is as urgent as ever: to inspire and prepare young people to succeed in a global economy by empowering them with the skills, confidence, and vision to build their own futures.

When we put hope out there, and hope wins, we take the dreams of youth and the daydreams of adolescents and awaken these young people to choice-filled lives, lives where they have agency. This outcome is only possible because of you. Through your support and partnership, JA Rocky Mountain students can write their own stories and sign their names with confidence, dignity, and determination.

But the true strength of JA Rocky Mountain lies in the ripple effect—how volunteers and community partners multiply the organization’s impact, one student at a time.

The Ripple Effect: Volunteers and Community

The impact of JA Rocky Mountain extends far beyond the students who walk through the doors of Finance Park. For volunteers like Natalie Artibee, the experience is just as transformative.

For me, I think it just reinforces the importance of what needs to happen. You see them start to understand and connect dots and appreciate what their parents do for them—it’s pretty cool.

“We walk away with so much as a volunteer—just that interaction with kids who are learning,” says Artibee.

The ripple effect is felt throughout the community. Many volunteers, initially intimidated by the technology or the prospect of guiding a room full of teenagers, soon discover the rewards of stepping outside their comfort zones. “We had three new people who’d never done it before, and so they were a little intimidated by the technology and a little intimidated about what a bunch of 11th graders were going to be like. At the end of the day, the kids know how to navigate the technology better than we do,” laughs Artibee.

Volunteers do more than teach budgeting—their role is to mentor, share real-life advice, and connect students to opportunities they might never have imagined. Artibee explains, “Our value is sharing stories, and you know what it means to buy insurance? What it means to buy furniture? I had one kid who said, ‘I just need an air mattress. I don’t want to spend money on a bed. That’s not really practical.’ Well, you probably do need a bed… Once these new volunteers realize the role, they want to be involved.”

For Artibee and her fellow Nelnet volunteers, giving back isn’t just about teaching financial literacy—it’s about building connections, opening doors, and inspiring the next generation to dream bigger.

As JA Rocky Mountain looks to the future, its mission continues to evolve to meet the needs of the next generation.

Looking Forward: The Next 75 Years

As JA Rocky Mountain celebrates its 75th anniversary, the organization isn’t resting on its legacy. Instead, it’s expanding its reach—adapting programs for younger students, launching career webinars, and embracing new technology to meet students where they are.

“The nice thing is JA really offers solutions for teachers at all grade levels,” says Natalie Artibee. “We can go into elementary school kids and read to them. We can do career webinars. We hosted a webinar with the class. We talk about a career, so they may be focused on cybersecurity and they might be focused on technology or People Services/HR, and so we bring in professionals from that space and we talk about what it’s like and we do interview simulations with kids in their schools and stuff like that.”

There are a lot of opportunities to engage outside of Finance Park that JA offers that are just amazing programs.

She adds, “It’s helpful for the teachers because you know they’re there every single day, the whole school year. And if some business professional is willing to come in and spend a couple hours with their kids, they get a little bit of a break. They’re learning something different. They can build on that. I think it’s awesome for the schools and they really appreciate it.”

But the future depends on continued community support, as Artibee knows well. “The biggest challenge is…getting enough volunteers that can get away to do some of these things or will want to do some of these things. So I’ve recruited a few people to just talk to a classroom. It’s 45 minutes. It’s their time. They can do it at their desk. Talk about their job. Any professional here can do that. And kids love it,” she emphasizes.

As JA Rocky Mountain looks ahead to the next 75 years, the need for volunteers, mentors, and advocates is greater than ever. The invitation is open: step in, share your story, and help shape the next generation of leaders.

Closing Scene

As the day winds down at JA Finance Park, Natalie Artibee stands back and watches as students gather their belongings, their simulated budgets tucked away but their minds buzzing with new questions. She sees the moment when a student’s eyes light up—when the numbers in their iPad suddenly connect to real life, to family, to dreams for the future.

“You can just watch them connect the dots and things start to make sense. It really is pretty cool to watch,” she says, a quiet pride in her voice.

For Artibee, giving back is more than a responsibility—it’s a philosophy. “I just feel like Nelnet pays me really well and I should give back. That’s just my philosophy,” she says. “If you have an opportunity, it’s four hours out of your day and out of a group of 80 or 100 students, you may just touch five or six of them, but they’ll take that away.”

As JA Rocky Mountain looks to its next 75 years, the invitation is simple: step in, share your story, and help a young person connect the dots. The ripple effect starts with one volunteer—and it can last a lifetime.

Combined with community partnerships and grants like the Nelnet Foundation’s support for JA Finance Park, these efforts ensure the next generation has the tools to thrive.