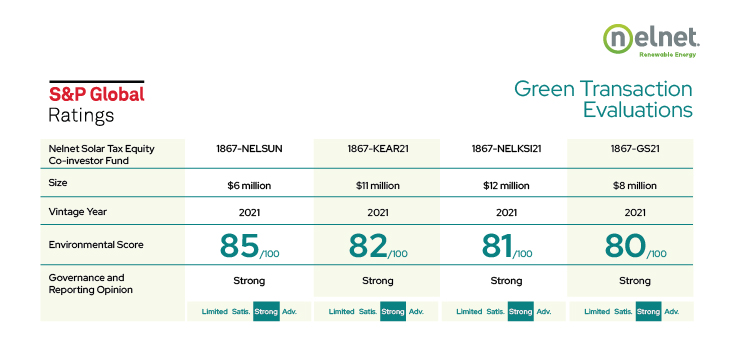

Nelnet Renewable Energy achieved high ESG ratings by S&P Global on four of its 2021 co-investor solar tax equity funds. This rating system is designed to raise the bar on corporate standards for sustainability. Let’s take a closer look at the evaluations.

Green Transaction Evaluations

| Nelnet Solar Tax Equity Co-Investor Fund | 1867-NELSUN | 1867-KEAR21 | 1867-NELNKSI21 | 1867-GS21 |

|---|---|---|---|---|

| Size | $6 Million | $11 Million | $12 Million | $8 Million |

| Vintage Year | 2021 | 2021 | 2021 | |

| Environmental Score | 85/100 | 82/100 | 81/100 | 80/100 |

| Governance and Reporting Opinion | Strong | Strong | Strong |

What are the Green Transaction Evaluations?

S&P Global Green Transaction Evaluations “provide a point in time score on the relative environmental benefit generated by a green/resilience financing and an opinion on governance and reporting.” These ratings utilize the expertise of S&P’s 1,500 credit ratings analysts and sustainable finance analysts worldwide to assess an issuer’s sustainability strategy and financing frameworks.1

What are Nelnet Renewable Energy’s scores – and what do they signify?

The four funds received environmental scores of 85, 82, 81, and 80; and all four received “Strong” governance and reporting opinions. The investment proceeds go toward funding solar photovoltaic (PV) projects, which support the displacement of electricity generated by fossil fuels. This facilitates community-wide decarbonization, and is a factor driving the high environmental scores of these investments. The renewable electricity generated by the solar PV projects will also have significant positive environmental impacts through avoided greenhouse gas (GHG) emissions. Green energy projects, including solar power, are considered long-term green solutions, and are therefore placed at the highest level of the S&P Global carbon hierarchy.

Find details on the individual ratings below:

- GS21 LLC Green Evaluation

- KEAR21 LLC Green Evaluation

- NELKSI21 LLC Green Evaluation

- NELSUN21 LLC Green Evaluation

As a significant investor and provider of administrative and management services for solar tax equity funds, these ratings showcase our commitment to allocate capital to high impact clean energy projects across the U.S. and our commitment to transparency, reporting, and high governance standards.

How do these evaluations demonstrate Nelnet’s core values?

Nelnet’s purpose is to serve others. As part of its capital allocation strategy, Nelnet conscientiously chose to invest in solar tax equity because it dovetails perfectly with the organization’s purpose and mission. Our associates are passionate about facilitating the transition to a net-zero economy and creating a better environment for future generations. Focusing on service and relationships makes it possible to have a huge impact in the lives of our customers, clients, stakeholders, and the community.

What’s next?

Nelnet Renewable Energy continues to be both excited and focused on long-term impact and growth in the renewables industry and providing a unique tax equity co-investment platform that makes it possible for our investors to reap numerous sustainability and investment benefits. For any who are interested, we invite you to learn more about tax equity co-investing.

If you’re a corporate investor or tax professional interested in learning how we integrate ESG factors into our solar tax equity investment process, download our white paper.