Your financial services company was not formed in a mold. Your services are different, your benefits are unique, and your measures of success are likely specific as well.

Despite all these variables, when it comes to loan application processing and servicing, traditional platforms were not designed to easily configure for unique features and reporting capabilities. These features end up bolted on, making them feel disconnected and clunky.

Are you ready to leave traditional platforms behind, streamline your processes, and create a wow experience for your customers? If so, you’re ready for Nelnet VelocityTM.

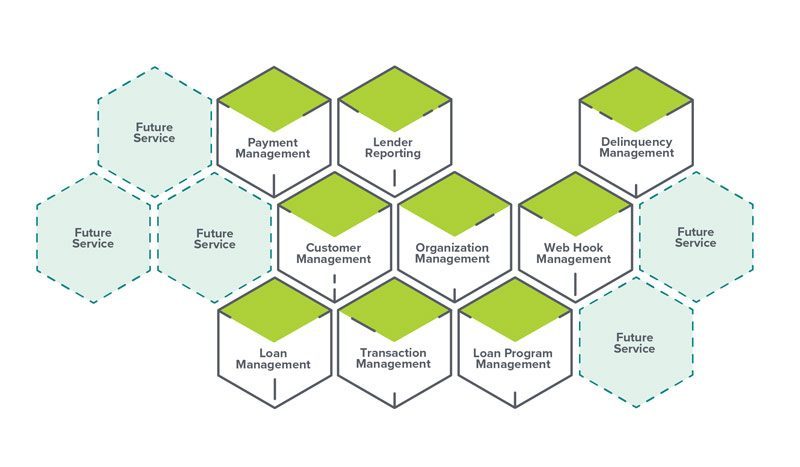

A Microservices Approach

Microservices are an important software evolution and one that can have profound implications in the digital transformation of your entire business. The emergence of microservices over monolithic architecture represents a fundamental shift in how software is developed, and one that has been successfully adopted by organizations like Netflix, Google, Amazon, and now Nelnet.

Nelnet’s new loan application processing and servicing platform — Nelnet Velocity™ — is microservices architected, setting a new standard for platform configurability. Microservices offer a flexible and efficient approach to building software, with an architecture that breaks large applications into much smaller pieces, each designed to do only one thing and to do it well.

Microservices allow developers to combine components in different ways, supporting specific tasks or business goals without forcing that work to follow a single standard approach. This design allows microservices-based platforms to break free of the rigidity of legacy applications while allowing for fast development of needed features without affecting other services, greatly improving speed to market.

For Nelnet, this microservices approach allows us to create service offerings that meet the specific needs of our clients, emphasizing integration and customer experience. By employing a microservices architecture, Velocity flexes to meet the demands of multiple customers and asset classes.

Benefits of microservices include:

- Agility: By breaking down functionality to the most basic level and then abstracting the related services, Nelnet can focus on only updating the relevant pieces of an application. This removes the painful process of integration normally associated with legacy applications. Microservices speed development, turning it into a process that can be accomplished in weeks and not months.

- Customer Experience: Each microservice is built around a set of business capabilities and is independently deployable, allowing you to customize your offerings to reflect your brand and to meet the needs of your customers.

- Flexibility: Microservices, along with APIs, help modularize and streamline business logic, empowering integration with nearly any business system that you request.

- Resiliency & Scale: By dispersing functionality across multiple services, we eliminate an application’s susceptibility to a single point of failure. The result? Applications that can perform better, experience less downtime, and can scale on demand.

- Speed to Market: The microservices architecture of our platform allows us to make changes quickly, while increased automated testing significantly speeds our delivery schedule, addressing your needs swiftly and reducing your time to market for each critical feature.

Organizations looking to maximize productivity, embrace agility, and improve customer experience should look beyond yesterday’s monolithic applications and embrace microservices, whose loosely coupled architectures speed development, testing, and deployment, accommodating today’s and tomorrow’s digital requirements.

Supported Processes

Velocity’s microservices architecture enables the use of services, including, but not limited to:

- Accepting payments.

- Managing customer information.

- Configuring loan programs.

- Delivering lender services.

- Reconciling transactions.

- Handling communications.

- Supporting innovative user experiences.

Request a Demo Today

Nelnet knows your business is unique, and you deserve a loan application processing and servicing platform built to handle your programs. Contact an expert today to request a demo and see how our microservices approach can be built to handle the intricacies of your programs.